Tax Brackets in the US: Examples, Pros, and Cons

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

By A Mystery Man Writer

A tax bracket is a range of incomes subject to a certain income tax rate.

Single vs. Head of Household: How Should I File My Taxes? - Ramsey

What is Regressive Tax and its Types? - Explained with Examples

People always say that after a certain point, it's not worth working overtime anymore because of the higher tax bracket you're put in. Is this true? - Quora

:max_bytes(150000):strip_icc()/flattax-34275c695b44480c8b89e7d359dd2084.jpg)

Is a Progressive Tax More Fair Than a Flat Tax?

Start Planning Now For A Higher Tax Environment Pay Taxes, 42% OFF

:max_bytes(150000):strip_icc()/free-trade-agreement-pros-and-cons-3305845-final-5b71e37f46e0fb002cdbc389.png)

Pros and Cons of Free Trade Agreements

What is Gross Income? Definition, Formula, Calculation, and Example

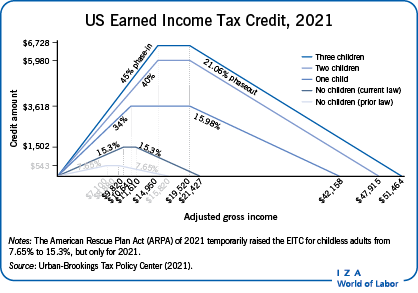

IZA World of Labor - Should the earned income tax credit rise for

Progressive tax definition & examples

:max_bytes(150000):strip_icc()/taxreturn.asp-FINAL-6421636a087d471d8c9b2e1a9788c577.png)

Tax Definitions

:max_bytes(150000):strip_icc()/businessincome_final-fdcbc653a7e049bab4707c62cf9cc407.png)

What Is Business Income? Definition, How It's Taxed, and Example

:max_bytes(150000):strip_icc()/GettyImages-619045930-243e95b9cc4349beba91af39ddc67f7e.jpg)

Personal Income Definition & Difference From Disposable Income

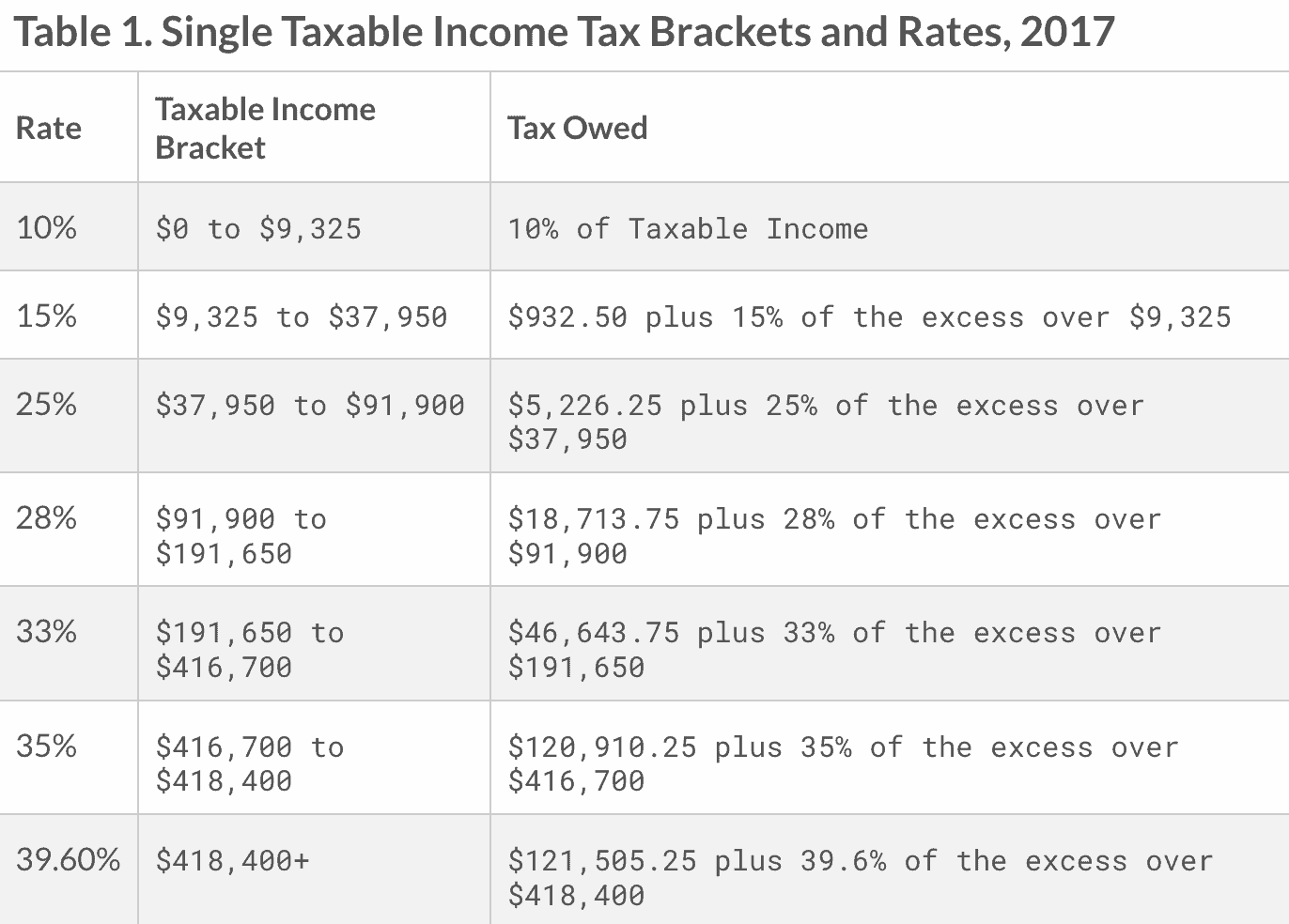

Tax brackets: Navigating the Marginal Tax Rates: Unpacking Tax

Standard deductions, tax brackets to increase due to inflation

:max_bytes(150000):strip_icc()/universal-health-care-4156211_final-5737902ad86c462e930875d1c0878130.png)

What Is Universal Health Care?

- Paint Cat Riding Shark Funny Sweatpants – D&F Clothing

- NWT Jellycat NIPPIT DUCK Soft Plush Toy CUTE Brand New Super Soft FAST SHIPPING!

- brandy melville black zip up hooded sweatshirt - International

- Artwog Large Print Wall Art on Canvas, Modern Marble Wall Art Print, Abstract Canvas Wall Decor, 1 Panel 24x16

- Bravado Gaming on X: You have $15. Who is your Katowice dream team?💸 Bonus points for a coach 🤫 / X