Low-Income Housing Tax Credit Could Do More to Expand Opportunity

By A Mystery Man Writer

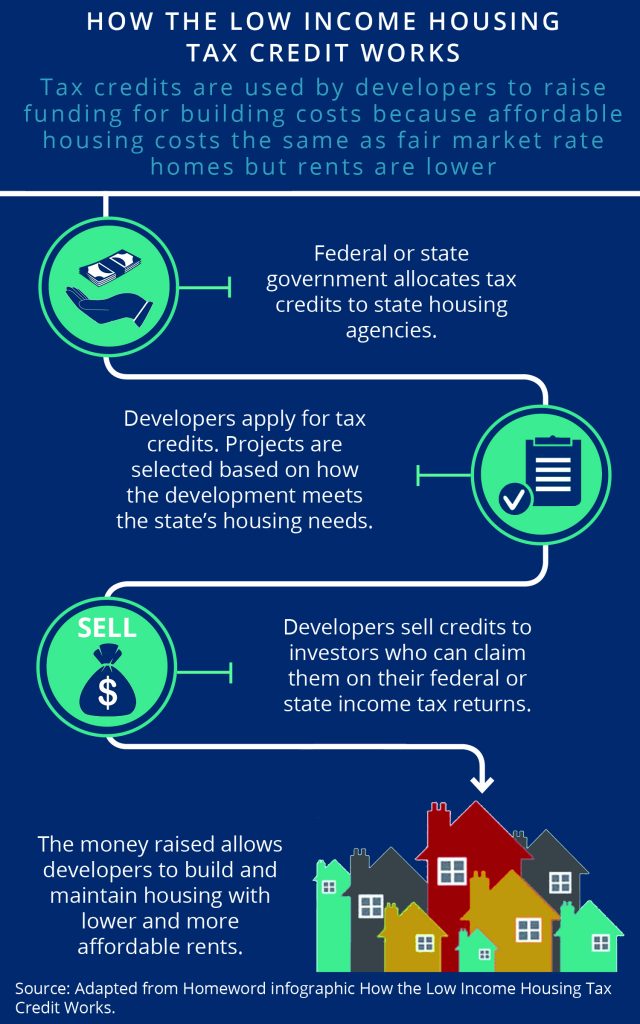

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

Low Income Housing Tax Credit: Invest in Communities and Reduce Your Taxes - FasterCapital

Housing Tax Credit Program Georgia Department of Community Affairs

PDF) Vouchers and Affordable Housing: The Limits of Choice in the Political Economy of Place

As US Housing Crisis Grows, So Does Hope for Bipartisan Tax Bill - Bloomberg

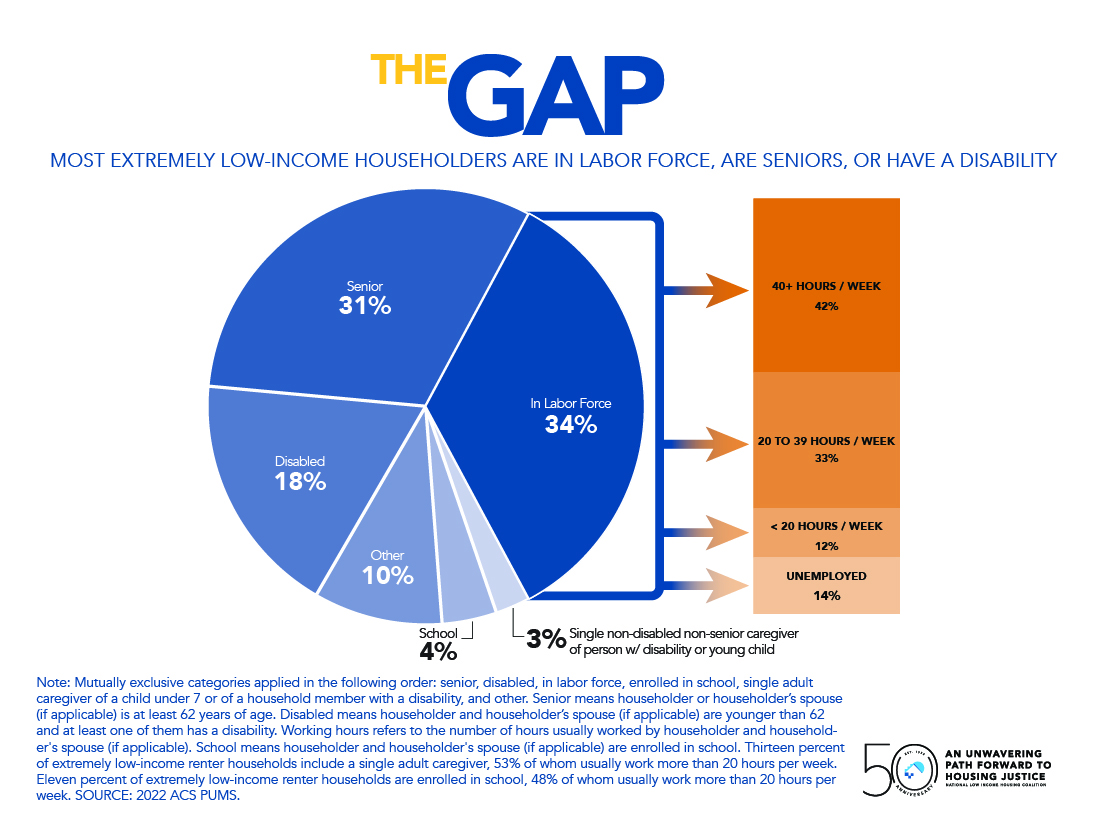

About National Low Income Housing Coalition

References, Rental Eviction and the COVID-19 Pandemic: Averting a Looming Crisis

State and Local Strategies to Improve Housing Affordability

Housing Mobility Strategies and Resources

Closing The Divide - Enterprise + FHJC, PDF, Affordable Housing

Low Income Housing Tax Credit Toolkit - Open Communities Alliance

Tax Legislation Announced by Tax-writing Chairs Wyden and Smith Would Temporarily Reduce 50% Financed-By Test to 30% for 2024-2025, Restore 12.5% LIHTC Boost for 2023-2025

The New Social Housing - Harvard Design Magazine

- How Your University Can Support Students from Low-Income Families - QS

- Coronavirus pandemic has harmed lower-income workers the most

- How to Buy a House in NJ with Low Income

- Equitable resources for residents of low income neighborhoods and communities of color - Local Housing Solutions

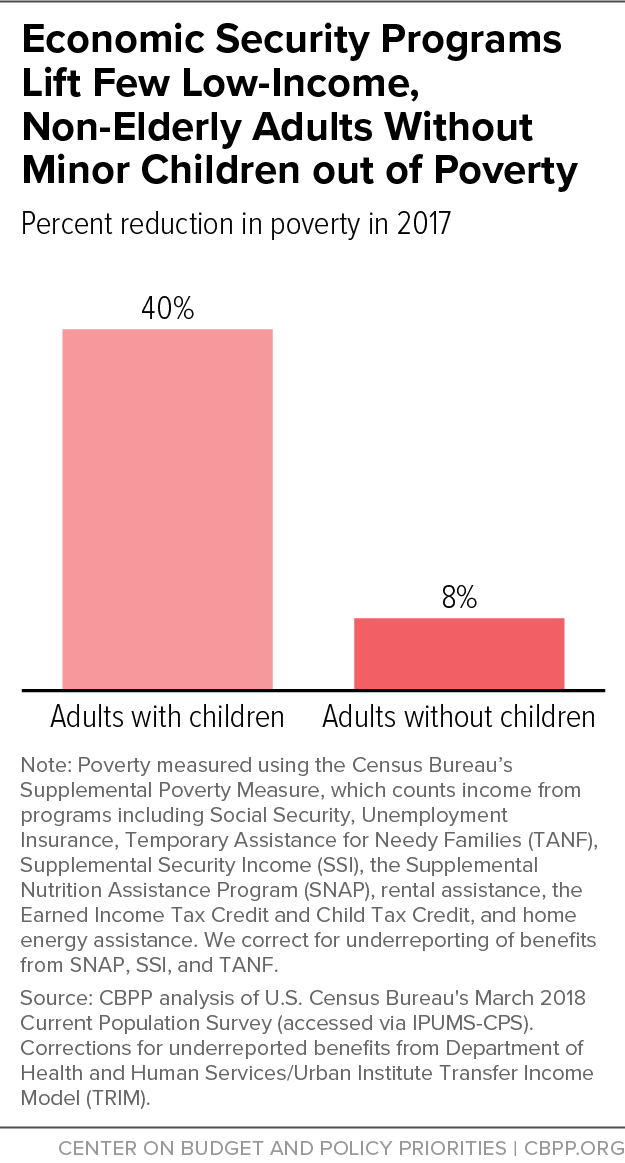

- A Frayed and Fragmented System of Supports for Low-Income Adults Without Minor Children

- High Waisted Yoga Pants for Women with Pockets Capri Leggings for Women Stretchy Workout Leggings for Women Yoga Capris

- Promise Line Drawing Stock Illustrations – 421 Promise Line Drawing Stock Illustrations, Vectors & Clipart - Dreamstime

- 10 pantalones fluidos de Zara con estampado elegante para eventos de verano: no marcan ni dan calor

- Meoliny - Leggings de cintura alta para mujer, con forro polar, pantalones ajustados gruesos de felpa, pantalones térmicos cálidos de invierno para yoga y deporte, gris oscuro, 33.3 pulgadas : Ropa

- Maidfenform® Love the Lift Plunge Push Up Bra, 36B - Smith's Food