Death of Seamless Flow of ITC in 2022 – Major Changes under GST

By A Mystery Man Writer

The wonder baby seamless flow of ITC which raised so many hopes and reduced the burdens, had been slowly placed into precarious health condition of late. On the Budget 2022 day it has been put on ventilator with no hope of recovery. The day when changes of Finance Act, 2022 are put into effect would be the date of death of seamless flow of ITC.

Not Maintaining Proper Documentation - FasterCapital

QRMP Scheme under GST w.e.f. 01st Jan 2021

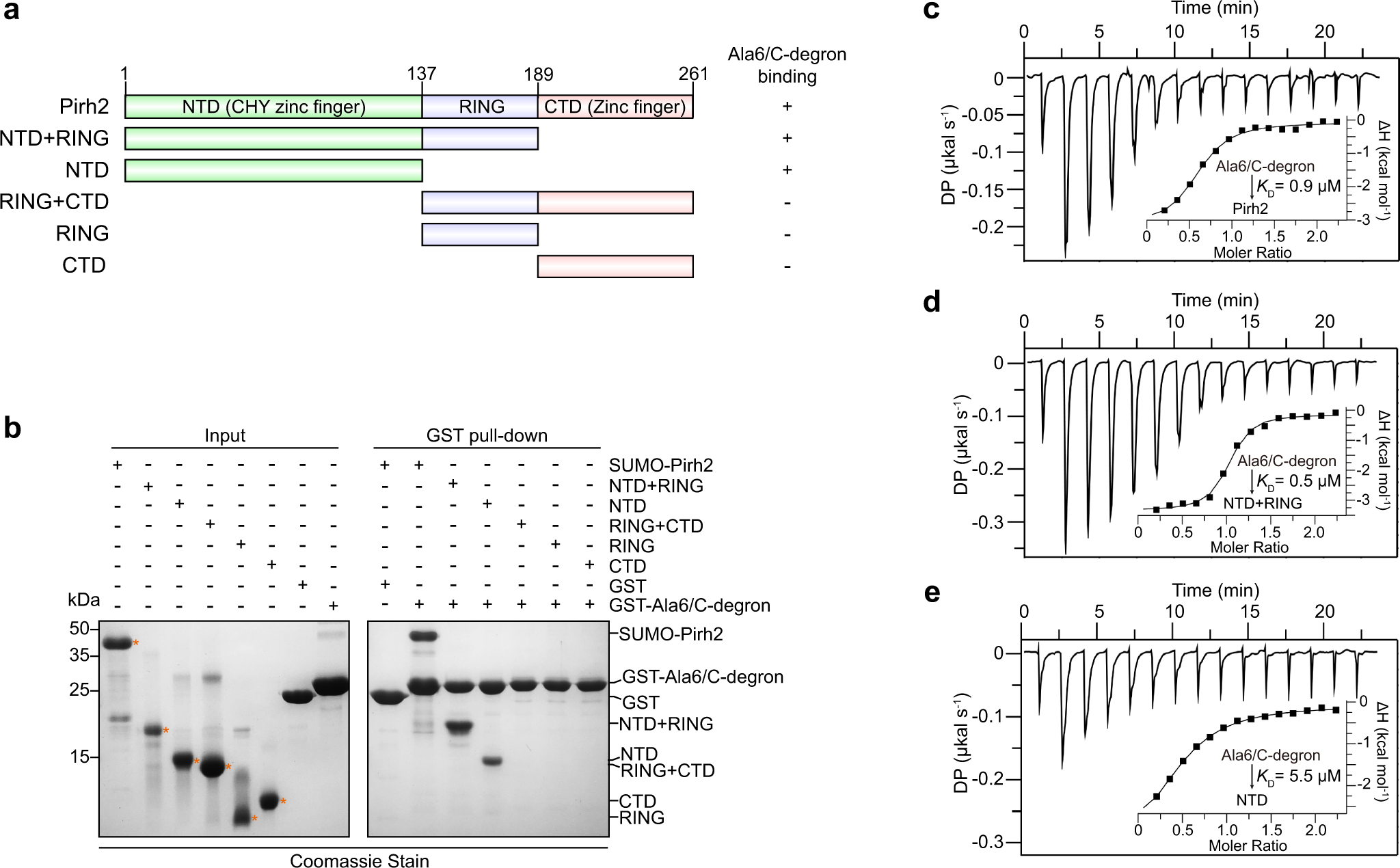

Recognition of an Ala-rich C-degron by the E3 ligase Pirh2

Major changes in GST made applicable from 01.10.2022

Part 9-GST - Areas of Business Impacted (1)

GST New Era in 2022: Important Changes effective 1st Jan, 2022

Are the GST filing dates extended? - Quora

GST Archives » Legal Window

How to prepare for GST

Chemical Today Magazine PDF August 2022 by worldofchemicals.com

Budget 2024 Expectations Highlights: NPS changes, infrastructure

Input tax credit under GST

Articles

- Building Resilience in Manufacturing: The Future is Seamless - Industry Europe

- Halara Seamless Flow High Waisted Butt Lifting Yoga Leggings

- Floral Textile Flower pattern Summer Seamless Flow by sytacdesign on DeviantArt

- Floral Textile Flower pattern Summer Seamless Flow by sytacdesign

- Lace: speed, simplicity, and seamless flow - IOHK Blog

- Plus Size Formal & Special Occasion Dresses

- Portal Line Luanda - Chinelas da Hermes Original Hermes para Mulheres Hermes para Homens Avenda a bom Preço Tel 945960665 Entrega ao domicilio Puxa ou liga

- Button UI Design Tips Marketpath CMS for Designers

- Men Merino Wool 250G Base Layer Crew Shirt 100% Merino Wool

- January 14, 2021, Vitoria, Espirito Santo, Brasil: (INT) Movement