Deducting Business Travel Expenses - A Self-Employed Guide

By A Mystery Man Writer

Being self-employed lets you deduct business travel expenses. Follow this self-employed tax guide to learn how to claim travel expense deductions.

Self Employed Expenses - What Can You Claim? Small business tax, Business tax deductions, Small business bookkeeping

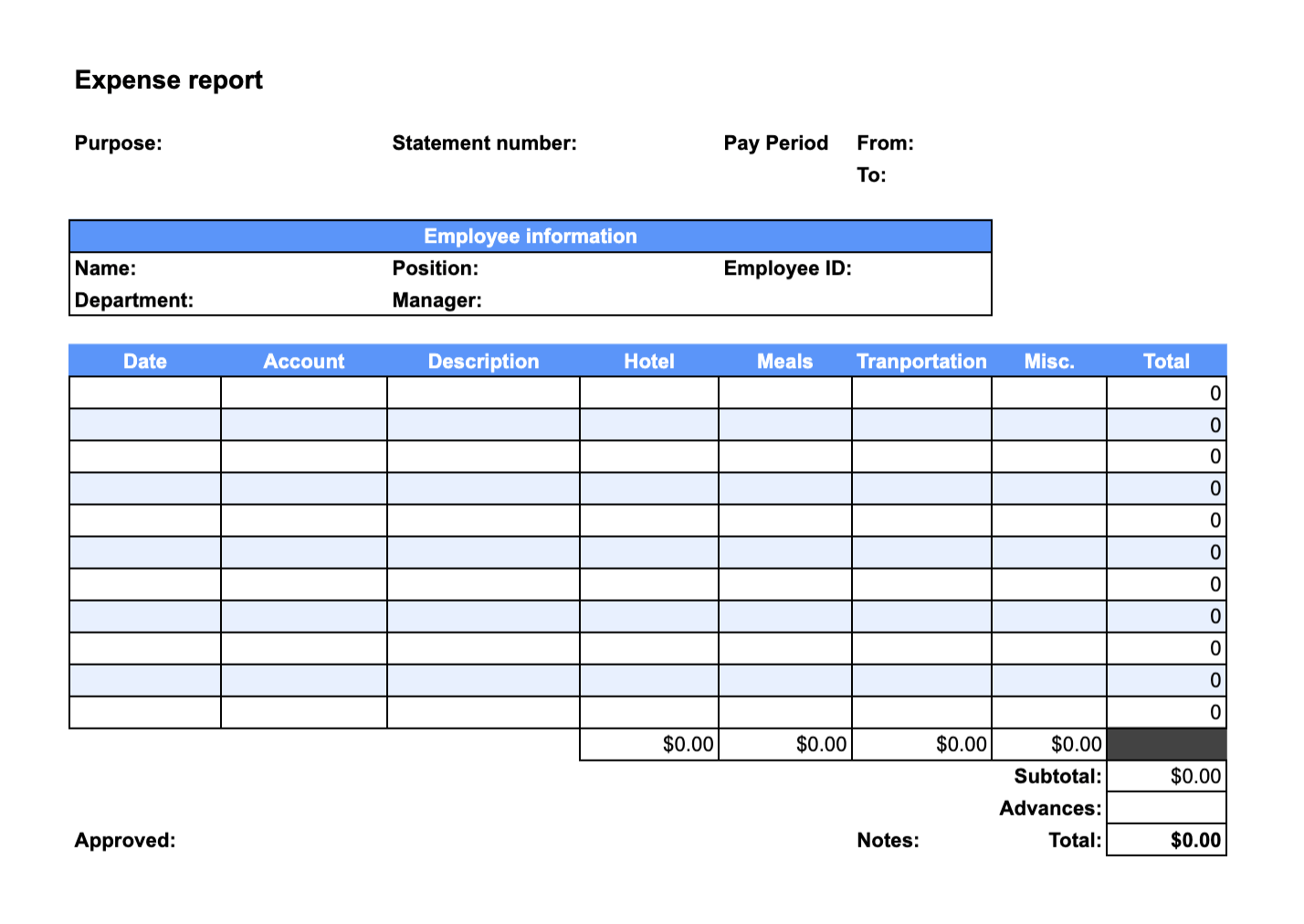

What Are Business Expenses? Definition, Types and Categories

Mileage Log Template 2024, Free Excel and PDF Log Book - Driversnote

The Complete List of Tax Deductions for Therapists

Home Office Deductions for Self-Employed and Employed Taxpayers

What are some Self Employed Tax Deductions in Canada?

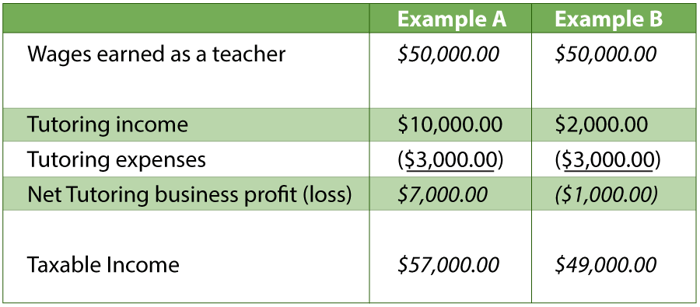

Business Related Travel Expenses Are Deductible

Self Employed Tax Return Canada – T2125 Step by Step Guide

How to Categorize Expenses and Assets in Business

Deducting Business Expenses – Which Expenses are Tax deductible?

Sara Mackey

Deducting Business Travel Expenses - A Self-Employed Guide

Entrepreneur's Guide: Self Employment Tax Deductions Demystified - FasterCapital

Self-Employed Worker Mileage Deduction Guide (2024 Update)

Business Expense Categories Cheat Sheet: Top 35 Tax-Deductible Categories

- Maidenform Firm Foundations High-Waist Firm Control Briefs 5000

- Handful Activewear (@handful) • Instagram photos and videos

- Women's Front Closure Seamless Bra, Thin Sports Bra With No Wire, Push Up, Anti-sagging, Prevent Side Spillage, Plus Size, Summer

- High Waisted Butt Lifter Padded Shapewear Shorts for Women Slimming Tummy Control Shaper Seamless Booty Pads Hip Enhancer Panty - AliExpress

- 25 Strangest New Year's Traditions From Around The World - Aging But DANGEROUS!