The Homeownership Rate and Housing Finance Policy – Part 2: The

By A Mystery Man Writer

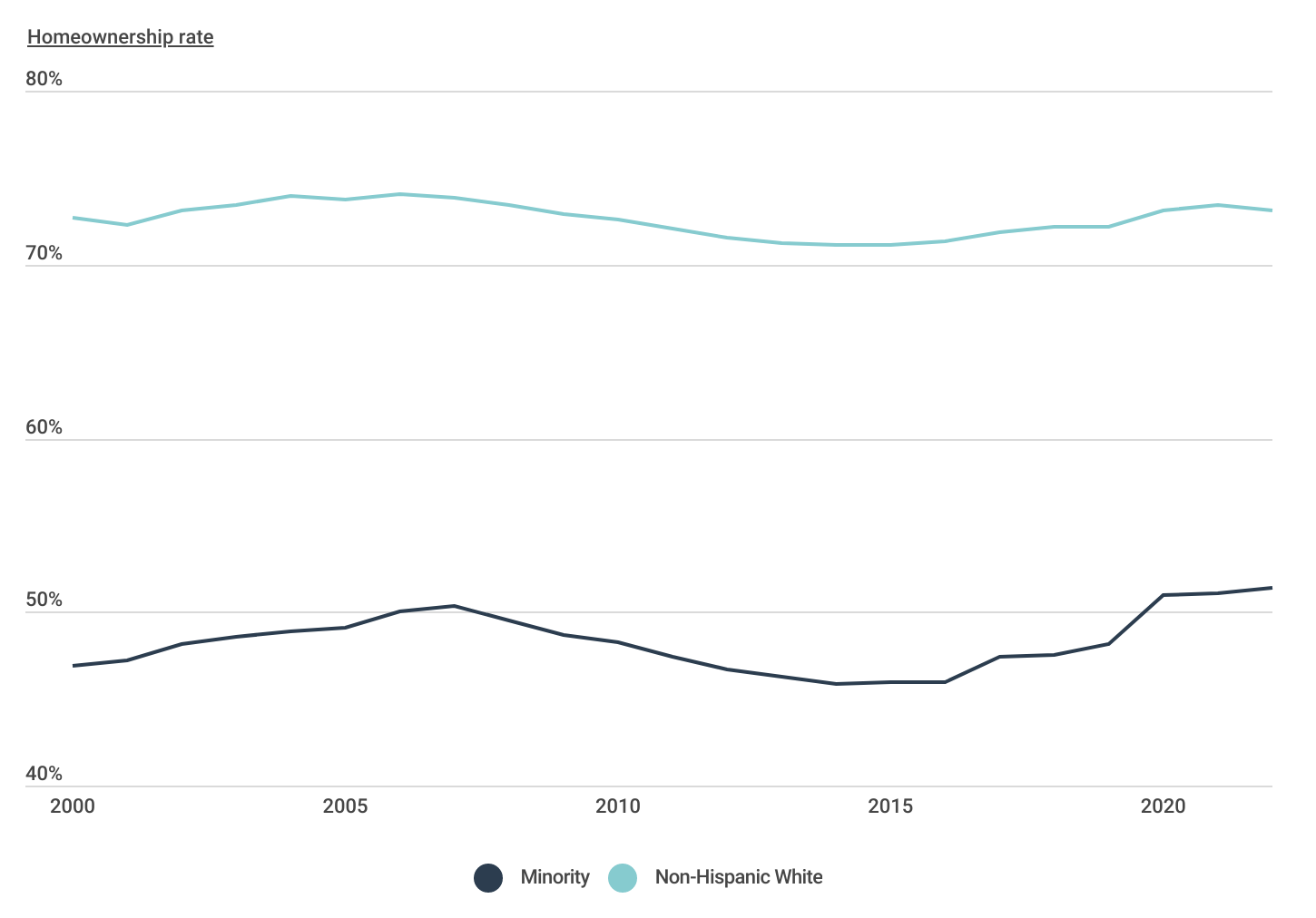

The homeownership rate is broadly regarded by policymakers as a core measure of how well the US socioeconomic system is delivering a good quality of l

Data Shows Lack of Manufactured Home Financing Shuts Out Many Prospective Buyers

Federal Housing Administration - Wikipedia

The Homeownership Rate and Housing Finance Policy – Part 1: Learning from the Rate's History

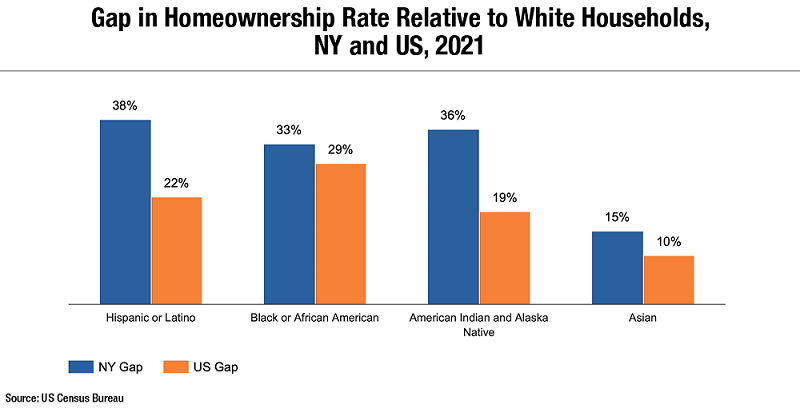

DiNapoli: NY's Homeownership Rate Lowest in the Nation

Can policymakers reverse the unequal decline in middle-age U.S. homeownership rates? - Equitable Growth

Californians: Here's why your housing costs are so high - CalMatters

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

HUD vs. FHA Loans: What's the Difference?

American Cities With the Largest Minority Homeownership Gap [2024 Edition] - Construction Coverage

Housing Stability and Tenant Protection Act: An Initial Analysis of Short-Term Trends – NYU Furman Center

Resolving the Millennial Homeownership Rate Paradox Perspectives - May 9, 2018

Don Layton Joint Center for Housing Studies

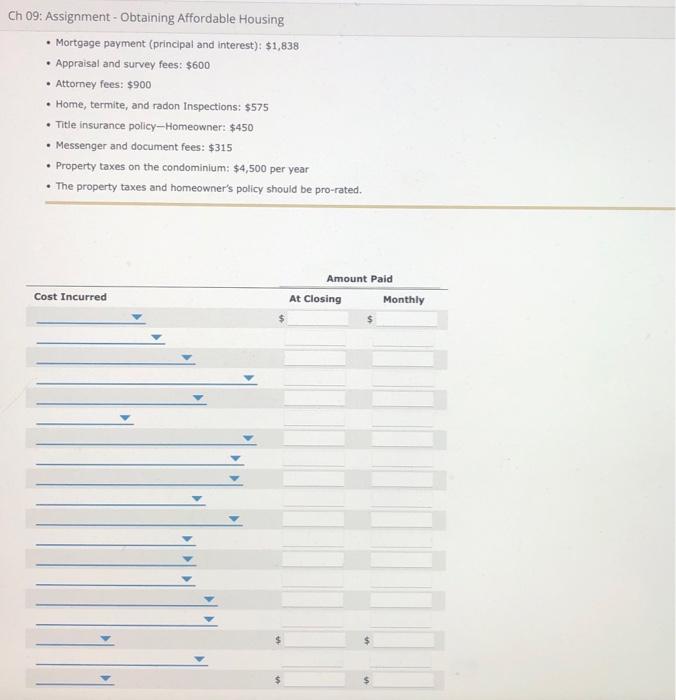

Solved 3. The benefits and costs of home ownership - Part 2

- 3 Pack: Womens Soft Capri Sweatpants Open Bottom

- St Patricks Day Fun Kelly Green Plaid Printed Boxers - ABC Underwear

- Womens Bali Comfort Revolution® Front Close Underwire Bra 3P66

- Build A Bear Hello Kitty Underwear Pink Corduroy Shorts

- Eashery Sticky Bras for Women Women's Wireless T-shirt Bra, Moisture-Wicking Convertible Smoothing Bra, Full-coverage Sky Blue XX-Large