Low-Income Housing Tax Credits

By A Mystery Man Writer

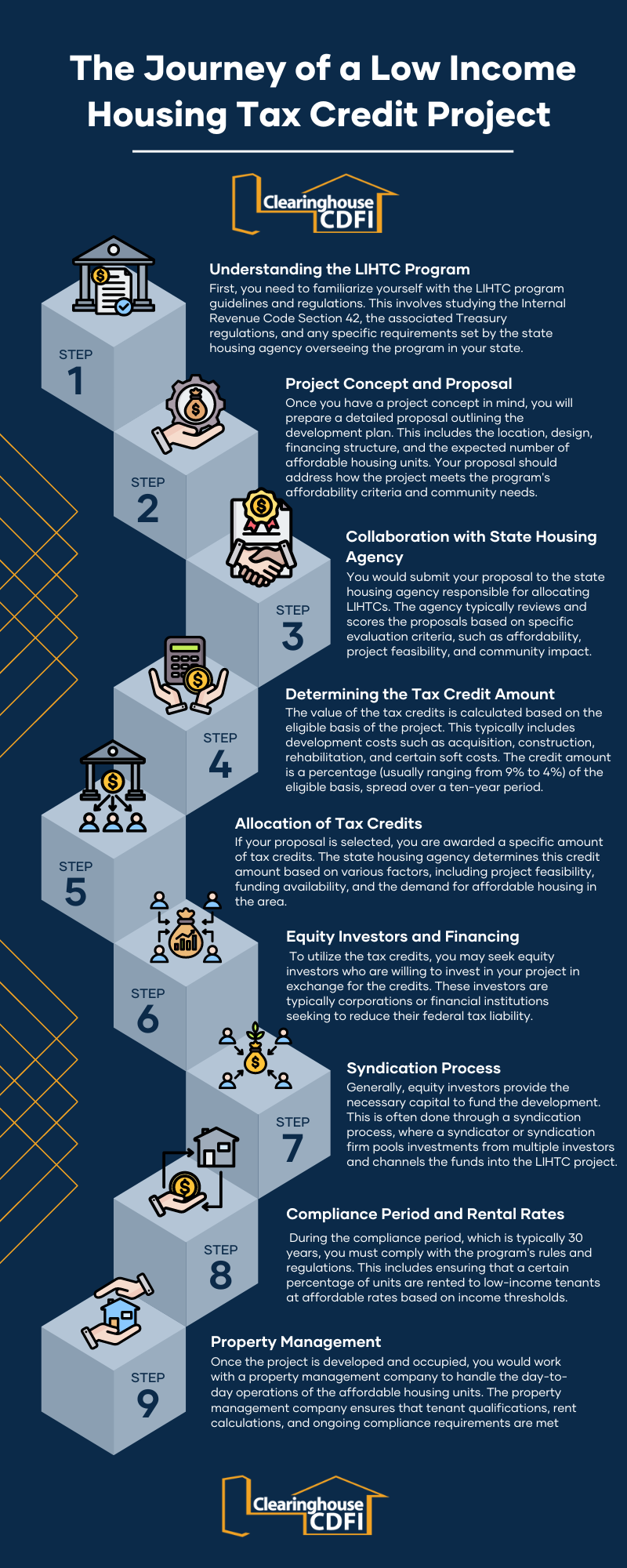

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

Panel approves Mo. low-income housing tax credit projects

NovocoTraining

Driving Community Impact with LIHTC

Low-Income Housing Tax Credits: Why They Matter, How They Work and

Banks See Big Benefits in Low-Income Housing Tax Credit Bill

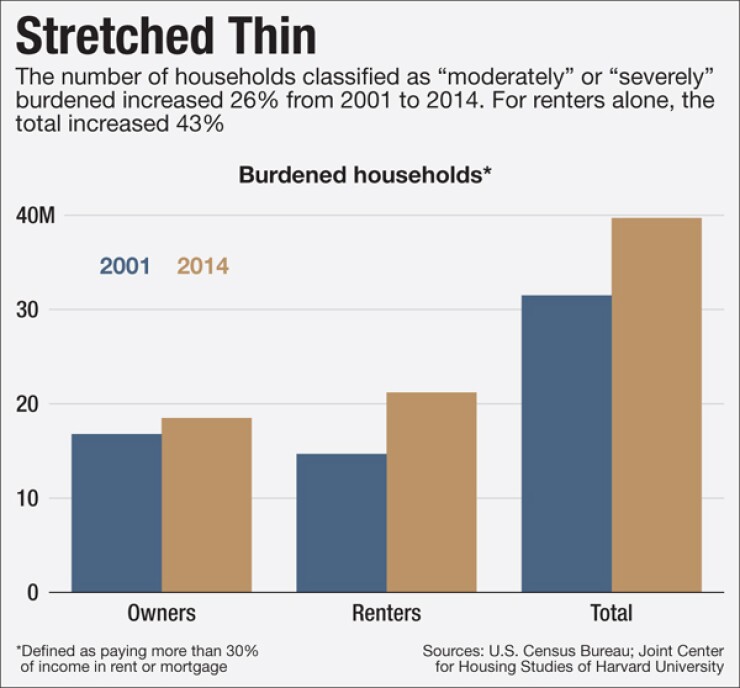

The Low-Income Housing Tax Credit Program Costs More, Shelters

2021 Low Income Housing Tax Credit Training - Building the Engine

LIHTC, Low Income Housing Tax Credits, Energy Rating

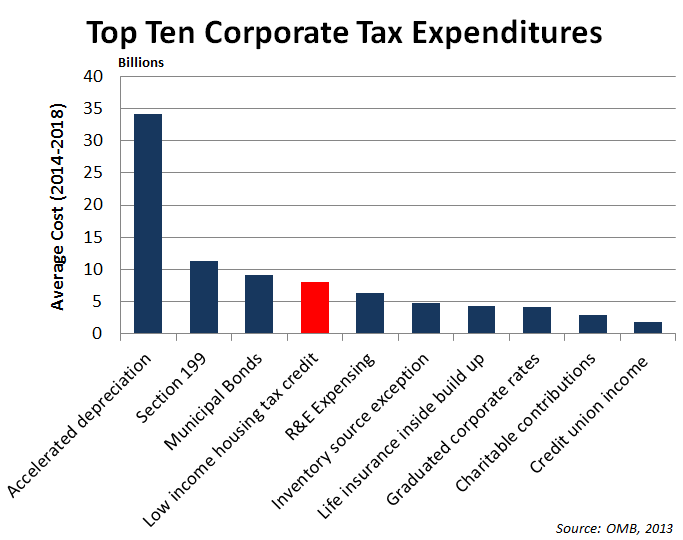

The Tax Break-Down: The Low-Income Housing Tax Credit-2013-11-07

The Low-Income Housing Tax Credit Program: The Fixed Subsidy and

Low-Income Housing Tax Credit (LIHTC)

Gary Cohen Presents on Low Income Housing Tax Credits: Shutts

Low Income Housing Tax Credits - Cinnaire - Advancing Communities

Texas Awards $67 Million in LIHTCs

A Guide to LIHTC by MHEGINC - Issuu

:format(webp)/https://static-sg.zacdn.com/p/agnes-b-1253-7765503-1.jpg)