Millennial Money: Navigating the SSI 'marriage penalty', National

By A Mystery Man Writer

For people who rely on Supplemental Security Income, or SSI, getting married can result in reduced monthly benefits and a lower amount allowed for savings. Individual SSI recipients can own up to $2,000 in resources, while couples can have a combined $3,000. Though these limits can dissuade some couples from marrying, exemptions for assets such as primary residences and wedding rings can help bypass these kinds of restrictions. Social Security programs such as Plan to Achieve Self-Support and Achieving a Better Life Experience also offer flexible savings avenues.

Gov. Gretchen Whitmer has 26 times the campaign cash Tudor Dixon does

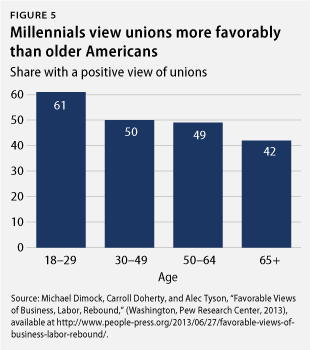

Promoting Good Jobs for Millennials - Center for American Progress

Millennial Money: Navigating the SSI 'marriage penalty' - The San Diego Union-Tribune

Millennial Money: Navigating the SSI 'marriage penalty' - The Washington Post

Third rail' heats up as Social Security reform talk increases

Millennials say their financial situation is dire

National Council on Disability

Millennial Money: Navigating the SSI 'marriage penalty

The Mecklenburg Times, March 26, 2024 by SC Biz News - Issuu

Ohio State has a surplus of quarterbacks at spring practice

The Washington Area Community Investment Fund (Wacif) Announces Shannan Herbert as its New CEO, Business & Finance

1 in 6 Brits say they've hidden debt from their partner, new research reveals

- My son is sexist. Should I make him wear a bra as punishment? - Quora

- Angry wife forces cheating husband to wear pad, bra as punishment - MyJoyOnline

- Bra Torture Device Poster for Sale by chronicallyill

- Punishment is Beauty Costume, Sexy Medusa Costume

- Dream Discipline Aqua Sports Bra – Dream Discipline Sports Apparel

- Hernia Belt for Women Pain Relief Recovery, Hernia Belt for Men Inguinal with Removable PU Pad and Adjustable Waist Strap,Hernia Truss Not Slipping

- HOW TO DRAW COTTON CANDY Easy & Cute Cotton Candy Drawing Tutorial For Beginner / Kids

- Keji 13cm Round Desk Clock Black

- 2023 Featherlite featherlite 3110 TILT #FT098

- Auden Lightly Lined Demi Coverage Racer Back Adjustable Bra Green 36C NWT