Solution to VAT Requirements for Non-UK Resident Companies - Seller

By A Mystery Man Writer

Introduction: In recent times, non-UK resident companies selling on have encountered a new challenge in the form of VAT requirements. is now asking these businesses to pay 20% VAT, regardless of whether they have crossed the sales threshold of £85,000.

VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK

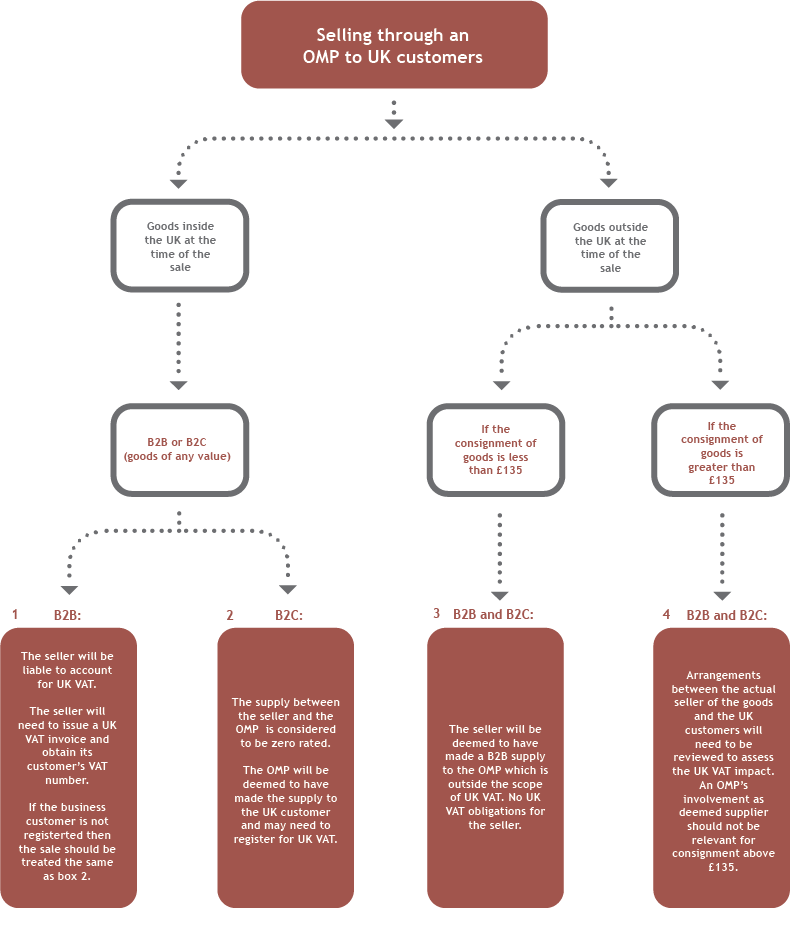

Business-to-consumer transactions: the new UK VAT rules for e-commerce

How To Register A UK Limited Company As Non Resident In 2024

EU: e-Commerce VAT changes 2021 - Global VAT Compliance

VAT: Agent vs Principal

Foreign Director VAT Registration for UK Limited Company as an Seller

Can I Sell on as a Non-US Citizen? Answers and Help to Get Started

Digital Taxes Around The World

How to check if a company is VAT registered

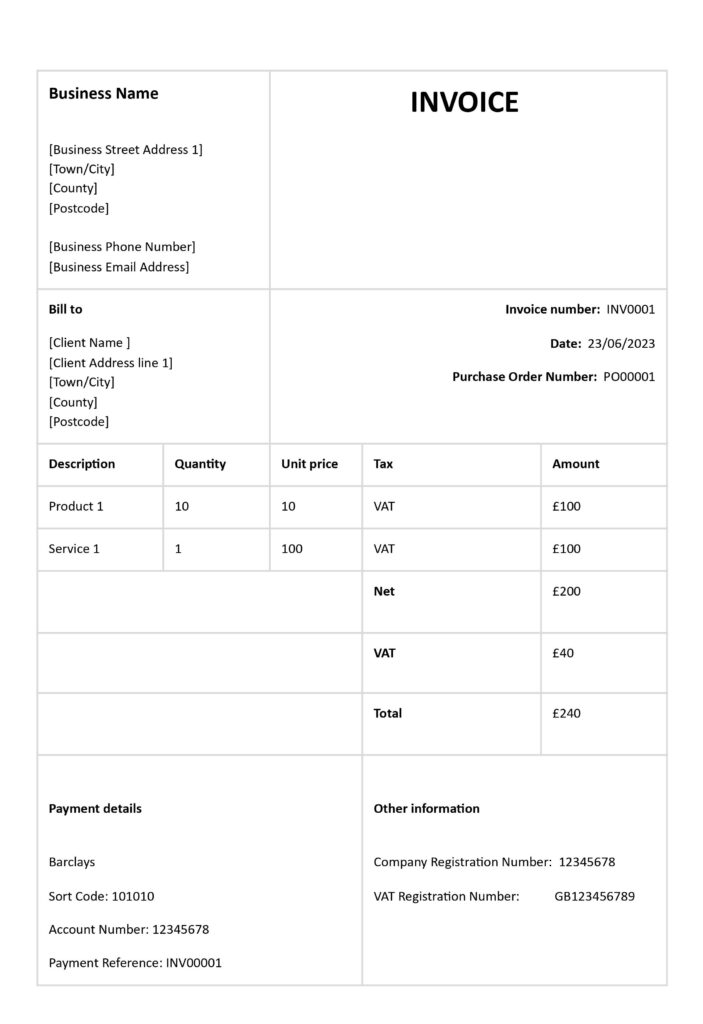

VAT Invoice Requirements: A Comprehensive Guide

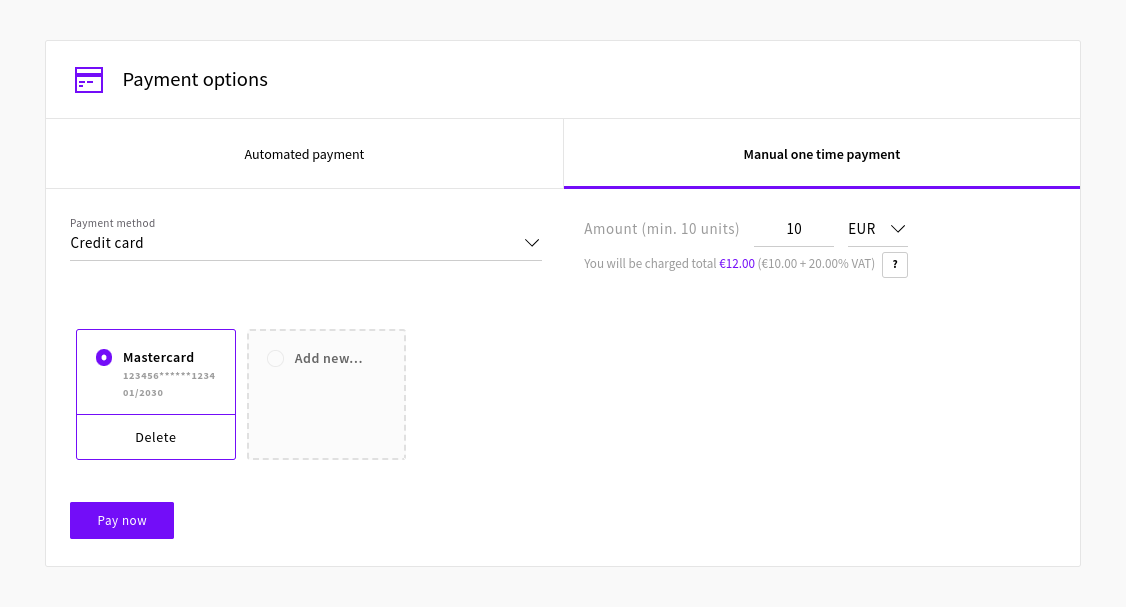

VAT and GST for international businesses - UpCloud

- New Fanatics Pro Team Issued Colorado Avalanche Coaches Training Pants Medium or large

- 4 x Happy Shorts Damen weiche Slips Höschen Unterhosen Unterwäsche marine weiß Valentin Herzen | Happyshorts - boxershorts & mehr online kaufen

- on X: The zipper tits aren't gonna like this one / X

- Long Front Door Handle for Home Decor, Textured Bronze Main Door

- YOGA para ESTRESSE com Camila Zen